On blockchain based crypto tokens

Disclaimer: I do not hold any stake in any blockchain based crypto token.

With the recent downswing in blockchain based crypto token prices, the hype about them has luckily died down a bit. If their prices (will ever) start rising again, however, my suspicion is that media will once again devote attention to them and many malinformed bandwaggoning decisions will be made (again). This post is an attempt to illustrate some fundamental limitations of blockchain tokens and their overwhelmingly harmful nature to a non-technical audience.

Blockchains and blockchain tokens

Blockchains come in two flavors: permissioned and permissionless. They share the underlying data structures of blocks being chained together by one block always directly referencing the preceding block. The main difference is who is allowed to add new blocks: In permissioned blockchains a central authority defines who is able to add blocks - therefore, this type of blockchains is also called private. In contrast, permissionless (or public) blockchains allow anyone to add blocks to the chain.

Both blockchain types can be distributed over multiple computers (nodes) which contribute computing power to calculate the next block (i.e. the process of mining). In this case, both types of blockchains need to make sure that the distributed ledger (the chain of blocks) is identical across all nodes. This is not trivial, as theoretically each node can suggest its own block. One way to foster cooperation between nodes is incentivizing them to play by the same rules: e.g. by only rewarding those nodes which computed the block which actually becomes the next one in the shared blockchain.

However, that is not sufficient for complete cohesion between the nodes. Therefore, the blockchain needs to be able to resolve conflicting next block suggestions. In case of permissioned blockchains the available consensus mechanisms between nodes are computationally efficient. In case of permissionless blockchains the consensus mechanisms are more complicated: a randomized but biased election mechanism determines what the valid next block is.

Since the crypto tokens discussed in this post are exclusively based on permissionless blockchains - since the removal of centralized power is one of their main promises - we will focus on their consensus mechanism subsequently.

Given that any node on the network can provide suggestions for the next block, the consensus mechanism of permissionless blockchains has to defend the blockchain from a Sybil attack: an attacker who - unbeknownst to the network - controls a majority of the seemingly independent nodes in an attempt to manipulate the vote on the next block. This is usually achieved by making the cost associated with undertaking such an attack larger than the reward from sucessfully mounting it. In short, the participation as a node in a permissionless blockchain must be expensive.

Since running a node for a permissionless blockchain is expensive, the nodes need to be compensated for their contribution of computing power. As there is no central authority on permissionless blockchains which could singlehandedly decide, what kind of reward and how much of it each contributing node should receive for its efforts, the reward has to be intrinsic to the blockchain building mechanism: The solution is to distribute tokens rooted in the very same blockchain to the miners. This is the origin of every cryptocurrency.

It is important to understand that these generated tokens are not at the center of the blockchain technology: blockchains are a way to create tamperproof records - nothing more, nothing less. The crypto tokens are an artifact of building a permissionless blockchain.

Economics of mining

Having a look at the microeconomics of mining permissionless blockchains provides interesting insights into the crypto token markets.

The starting point is that miners are rewarded in crypto tokens for their contribution to the computation of the next blocks on the blockchain. To increase the amount of tokens which they are awarded for computing the next blocks, they have to increase the amount of computing power dedicated to the problem. Now, computation is a field where one can realize massive economies of scale: the dollar cost per computational unit decreases with more computational units. This is the underlying reason, for most cryptocurrencies being mined by only a handful of mining pools:

“Bitcoin mining capacity is highly concentrated and has been for the last five years. The top 10% of miners control 90% and just 0.1% (about 50 miners) control close to 50% of mining capacity.” - Makarov & Scholar

The economic realities of permissionless blockchain computing already cast doubts on the decentralisation promises of blockchains (more on that later)!

Now, the big miners managed to increase their payouts in tokens by scaling up their investments in computational resources. Their operative costs and capital expenditures, however, are usually expressed in terms of fiat currency. Therefore, an exchange between cryptocurrency and fiat has to exist (or come into existence when credit lines run out). For the miners to churn out a profit, the following relationship has to hold:

$$ p_t \times n_t \gt c_c + c_o $$

Given that for each individual miner there are fairly inflexible constraints on the number of tokens mined \(n_t\) as well as the capital costs \(c_c\) and operational costs \(c_o\) incurred, the price of the token \(p_t\) is the driving variable for every miner’s bottom line. This fact creates perverse incentives to keep the price as high as possible. No means are off limits: The spectrum starts at creating a social media hype and ends with market manipulations.

On the value of blockchain tokens

Miners need to sell (some of) their tokens to cover their expenses. Now, why would anyone be on the buy side of a cryptocurrency to fiat exchange?

The only two reasons for why someone would buy a crypto token are:

- A useful application of the crypto token (in which case it would be an investment).

- The belief that the future exchange rate at \(t_1\) can be expected to be higher than now because another buyer will expect an even higher exchange rate at \(t_2\) (in which case it would be purely speculative).

Can a blockchain host a useful application?

Theoretically, yes. A blockchain is a valid way of creating tamperproof historical records.

In reality, there are two problems, however:

- In cases where the task at hand is indeed the creation of a tamperproof historical record there are superior technological solutions which do not involve a blockchain1.

- In cases where the main goal is the application of the blockchain based token as a facilitator of some kind of transaction, the underlying blockchain technology - again, it is a tool to prevent the manipulation of records - is completely abused.

Since I am concerned with crypto tokens in this post, we’re clearly in problem field 2: as evidenced by the fact that noone is interested in the actual transaction records on the blockchain!

Therefore, the real problem crypto miners and crypto enthusiasts have to solve, is that it is not the blockchain they want to find a use for, but rather a use case for the blockchain artifacts.

Can blockchain tokens have a useful application?

Theoretically, yes. Practically, no.

While human society is great at engineering shared illusions (e.g. money2, body corporate, nations, religion), these ideas have to be useful to come to bear. Given that crypto token proponents have had more than a decade3 to find a convincing application for their tokens but failed to do so up until now does not bode well for the future.

To some extent I understand their plight: their task is an incredibly difficult one. Since the tokens are bound to a blockchain - whose goal is to create unchangeable records, not to be fast or scalable - making these tokens useful becomes very difficult. In addition to that, these tokens have to be better than what we currently have in place in whatever they try to accomplish.

Various crypto token application suggestions have been made. We discuss some of the most prominent ones here.

Payment tokens

Due to the constraints imposed by the underlying blockchain technology these tokens cannot serve as a currency in the sense of being a transactional medium. They are simply too slow and expensive. It is very telling that attempts to alleviate this problem (e.g. by the Bitcoin Lightning Network) actually leave (!) the realm of the blockchain to facilitate payments. Naturally, the question arises why do we need a token constrained by a blockchain in the first place when we could simply use one which is also limited but not based on a blockchain?

Store of value

Another argument brought forth by crypto proponents is that due to many crypto tokens’ cap on issuance, the tokens can function as a store of value and protect from inflation. With the extraordinarily high observed volatility of crypto tokens, that is a tough argument to make. Even if the wild price swings were absent in crypto token markets, a store of value requires a whole bunch of people to share the illusion of it being a store of value. And then there is already at least one asset which is widely believed to store value: gold. How are crypto tokens better as a store of value than a metal which has technological applications and has for centuries served humans as a status symbol?

Smart contracts

Another attempt to offer added value in comparison to currently used payment systems is to allow for automated transactions on the blockchain in so called smart contracts - programs which trigger the exchange of crypto tokens under certain conditions without the involvement of a human being.

This sounds appealing until one realizes that a smart contract is code written by a falliable human. Who double checks this code? Is it feasible to double check every single smart contract one enters for bugs? What happens if an erroneuos transaction is triggered and permanently written to the underlying blockchain?

And even here the underlying blockchain imposes its limits: computational “power” and storage on the Ethereum blockchain is prohibitively expensive. If credit card fees seem excessive, blockchain fees are modern day robber baronry.

NFTs

Effectively, non-fungible tokens are http(s) links saved on a blockchain. That’s it. Think about it, links in an unalterable data structure pointing to some web server sold for millions of dollars!

How someone was willing to pay 410 ETH (which translates to slightly more than 1 million USD at then current prices) on 05.05.2022 for having a record saying that one paid4 410 ETH for a link to the PNG file above is completely beyond me. At least I can find solace in embedding the picture underlying the NFT here5, thus making this my first million dollar blog post.

In addition to being completely dumbfounded by what is going on here, I am also aware of the huge technological attack surface: from the Ethereum blockchain, to the OpenSea exchange, the domain name where the NFT points, the web server hosting the actual image, or the clients displaying the NFTs. If anything in that chain is attacked successfully, the above 1 million USD can turn into a crap smiley in an instant.

“web3”

The current web (“web2”) is for a very large part dominated by a few companies who generate massive cashflows from providing services modern society relies on. Compared to the early web (“web1”) which was a network of independent nodes, the modern internet with its walled gardens (aka platforms) is significantly more centralized.

Crypto enthusiasts like to picture a blockchain powered “web3” as a viable alternative: the functionalities of the current web but distributed because it is based on a blockchain.

Moxie Marlinspike, the lead developer of the cryptography protocol which encrypts billions of messages every day, deals with these claims in his blog post on “web3”. A summary of his arguments:

- Distributed apps are normal websites with the only difference that the state of the website does not live in a central database but on the distributed blockchain.

- Now, the blockchain only really lives on various servers: desktop and mobile devices interacting with the distibuted app do not hold a copy of the blockchain.

- Instead, end clients use services to parse the information on the blockchain for their requests.

- Economic logic will inevitably lead to a few or a single dominant API service(s). Decentralisation is nowhere to be seen.

While there are efforts at decentralizing the web and the technologies powering it (e.g. the ActivityPub or Matrix protocol), they have absolutely nothing to do with blockchain or crypto tokens. The latter will do nothing to solve the problem - at most they will change who makes money on the web.

Fairytale promises: Decentralisation and distributed trust

Crypto enthusiasts promise decentralisation and distributed trust wherever they go. They portray crypto tokens and blockchain as the solution to power imbalances and the elimination of untrusted actors like commercial banks, central banks or governments.

On a practical level, they fall short of their promises for two reasons: First, all their infrastructure builds on the infrastructure they try to replace: They need fiat currencies. They need banks. They need reliable jurisdiction. They need the web infrastructure. Everything they build is layered on top of what we currently have. Suddenly one has to trust more parties, rather than less. Second, the economic realities of the web and blockchain mining will always push the ecosystem (mining pools, crypto exchanges, NFT platforms, wallet apps, etc.) in the direction of a centralized system with powerful intermediaries.

On a more fundamental, theoretical level, the promises of decentralisation and distributed trust will never materialize either. Because even in the ultimate vision of crypto enthusiasts trust is not eliminated, but shifted: Instead of trusting the US dollar, one would have to trust in the Bitcoin and its ecosystem. Instead of trusting one’s bank, one would have to trust one’s wallet app or exchange. Instead of trusting jurisdiction, one would have to trust the code powering the blockchain platform and the smart contracts.

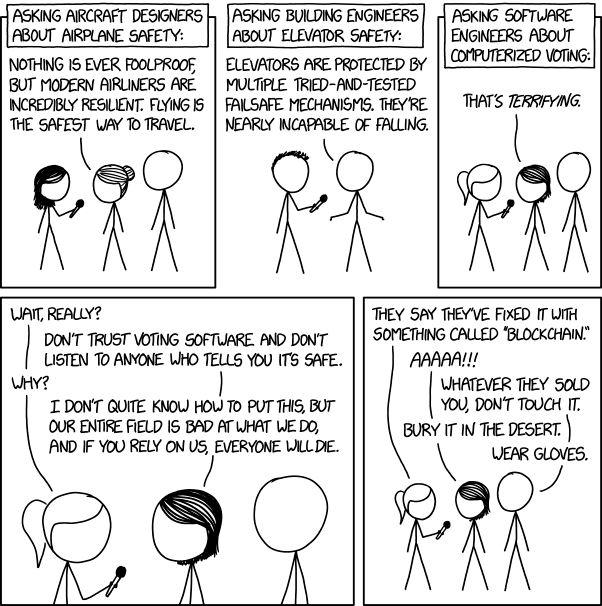

As a software engineer, I wholeheartedly agree with the following xkcd comic:

- You should not blindly trust software developers!

- Blockchain is not a solution to most problems. If the buzzword is used to sell you stuff, run!

The second point alludes to what the whole crypto “asset” movement is all about in my opinion: Making money off of (gullible) speculators by feeding them promises of revolutionary innovation involving decentralisation and distributed trust which will never materialize after no convincing real life use case for the crypto token was to be found.

Negative externalities

In addition to not having any material use cases or applications, blockchains, blockchain tokens, and blockchain miners have significant negative externalities: they incinerate the planet, facilitate criminal activities, damage legitimate businesses, and drive up computing cost for regular end consumers.

The climate as collateral damage

The most common consensus algorithm used by blockchains is called Proof of Work. It basically requires nodes to solve computationally intensive math problems as fast as possible to be rewarded. To be clear: These math problems are of a purely theoretical nature. They do not calculate weather models or do scientific computations. Instead, it is a normed number crunching task. Since running a node in a permissionless blockchain has to be expensive to prevent a Sybil attack (refer to the section on blockchain mechanics) while individual miners have the incentive to constantly increase their computing power to increase profits from economies of scale (as described in the section on the economics of mining), the difficulty of the math problem at hand is constantly increased. This leads to ever more scarce resources being directed at ever more useless computations. The arms race between miners and the constant increase of the computational intensity leads directly to the consumption of humongous amounts of energy (according to the Cambridge Bitcoin Electricity Consumption Index the estimated annual energy consumption of the Bitcoin blockchain amounts to 153.67TWh - that is approx. as much as Poland, a country of 40 million, consumes per year).

In addition to that, the electronic equipment used to carry out those computations has an estimated average lifetime of just 16 months6. Again, for solely the Bitcoin blockchain, this translates to an estimated annual e-waste amount of 30.7 kilotons in 2021. This is equivalent to the annual small IT equipment waste of a country like the Netherlands.

Faced with this criticism, crypto proponents usually either defend the high energy consumption (and e-waste generation) of the Proof of Work consensus mechanism or promise switching blockchains to alternative, less energy-intensive, consensus mechanisms.

But even if the energy required for the computations necessary for Proof of Work blockchains to work was fully sourced from renewable energy sources 100%, we’re still left with the energy used for producing the e-waste. Let’s assume these computation devices are also produced exclusively with renewable energy. Then the question becomes a matter or priorization: Do we, as humanity, have enough renewable energy available globally to allow ourselves to channel this amount of energy into the pointless computation of SHA256 hashes?

Commonly floated consensus mechanisms to replace Proof of Work are Proof of Space and Time and Proof of Stake: Proof of Space and Time uses storage space instead of computational power as a metric to keep the costs of a Sybil attack high. While this approach theoretically solves the energy consumption problem, it exacerbates the e-waste issue. A real-life attempt of a blockchain based on this principle failed spectacularly: the capital tied up in the hardware running the blockchain nodes surpassed the market cap of the associated crypto token. Proof of Stake is flawed in an even more serious way: Because those blockchain participants who have the most coins to stake, will end up having the most influence on what the next blocks of the blockchain are gonna be. The algorithm basically boils down to “power to the powerful”.

Criminal activities powered by crypto tokens

Given their high costs and lack of acceptance in exchange for goods and services, non-speculative transactions of crypto tokens are in the minority already. Of the transactions with a real world background, some are legit, some are criminal. While the exact proportions are unknown to me, the point here is that a lot of criminal activities could expand with the help of crypto tokens: Basically all ransomware attacks these days make the ransom demands in cryptocurrencies. Drug dealers sell drugs online in exchange for cryptocurrencies. Same goes for illicit weapons trade. While none of these criminal activities would cease to exist without cryptocurrencies, their scale would be significantly smaller because of the logistical difficulties involved.

Conclusion

What gives?

We have established that blockchains create tamperproof records. Public/permissionless blockchains reward their “miners” with blockchain based tokens for their computing power. The miners’ bottom line is first and foremost determined by the price of the token - and they need to exchange it to cover their fiat currency costs.

Despite being around for more than a decade, crypto tokens have not seen any useful application. The underlying (abused) technology severely limits their potential use cases going forward. In addition to lacking a single convincing use case, they come with an outrageous environmental footprint.

However, crypto proponents (whose bottom line depends on the perceived value of the token) promise decentralisation and distribution of trust away from powerful institutions like banks, central banks, and governments. Upon closer inspection it becomes clear, that these promises cannot possibly be fulfilled.

How come crypto “assets”’ market capitalization is in the billions of US dollars then? Well, why was one tulip bulb worth five times the average house price in the 17th century Netherlands? Put simply, there is money to be made in speculation! Miners, exchanges, and whichever business or “investor” has exposure to crypto “assets” has a vested interest in creating a hype for crypto tokens and creating the illusion of them being valuable. And as long as they find buyers around who think they can sell their crypto “assets” at a higher price later on, the market will continue to assign the crypto “assets” a non-zero price tag. Despite the fact that they are economically useless.

Nicolas Weaver, a computer science researcher at Berkeley, gives the IMHO only possible prudent advice to anybody considering to get involved with blockchain tokens in a 2019 talk with the title “Cryptocurrency: Burn it with Fire”:

In conclusion, it is a dismal space. Private and permissioned blockchains are an old idea - a good idea - just with a new buzzword on it. The public blockchains are grossly inefficient. The cryptocurrencies don’t work for buying anything [except] drugs and [paying] ransoms and stuff like that. Smart contracts are an unmitigated disaster unless you like comedy gold. And the field is just recapitulating 500 years of failures. So in the end, the only winning move is not to play - unless you like playing with flamethrowers.

Additional sources

In addition to the sources linked directly in the blog post, I can recommend having a look at

- David Rosenthal’s talk at the RRI/Vanguard conference in winter 2021 and an extension of it at a lecture at Stanford University. For a much more in-depth analysis of non Proof-of-Work consensus mechanisms, refer to his dedicated blog post.

- Molly White’s Web3 Is Going Great project which provides “some examples of how things in the blockchains/crypto/web3 technology space aren’t actually going as well as its proponents might like you to believe”.

- Werwolf’s blog post on blockchains, NFTs, and “web3”.

- rich collection of resources on crypto/web3

- part of why Mozilla stopped accepting cryptocurrency donations

- Crypto is the ‘commoditisation of populist anger, gambling and crime’

- European Central Bank’s damning critique of Bitcoin and explanation why caveat emptor does not apply to crypto. In a speech in June 2023 Fabio Panetta, Member of the Executive Board of the ECB, exposed the crypto industry for what it is: a “deleterious” form of finance “riddled with market failures and negative externalities” used for gambling and bypassing regulation.

- Ex-AWS engineer describing AWS’ vain search for use cases of the blockchain technology

- Drew DeVault’s unfinished but extensive slide deck on cryptocurrencies

- Jorge Stolfi’s “Bitcoin is a Ponzi” and “Yes, bitcoin is a Ponzi” explainers

- An anatomy of bitcoin price manipulation

-

“There is no single person in existence who had a problem they wanted to solve, discovered that an available blockchain solution was the best way to solve it, and therefore became a blockchain enthusiast.” - Kai Stinchcombe ↩︎

-

Central banks go to great lengths to uphold this particular shared illusion. ↩︎

-

Satoshi Nakamoto popularized the blockchain mechanism for Bitcoin in a paper from 2008. ↩︎

-

In all likelihood, wash trading. ↩︎

-

This is completely legal. NFTs do not prove any kind of ownership. ↩︎

-

By then the equipment is outdated in the arms race between miners. ↩︎